Insights and Strategies

Sell in May...Not Today

We rely daily on simple rules to navigate the world around us. Heuristics are mental shortcuts commonly used to simplify problems and avoid cognitive overload. While spending the time to thoughtfully consider all the possible scenarios may produce a more optimal outcome, a mental shortcut often offers a satisfactory solution. If it's cloudy outside, we bring an umbrella. However, if we had opened the weather app, we would have learned it would be a beautifully sunny day during the hours we planned to be outside.

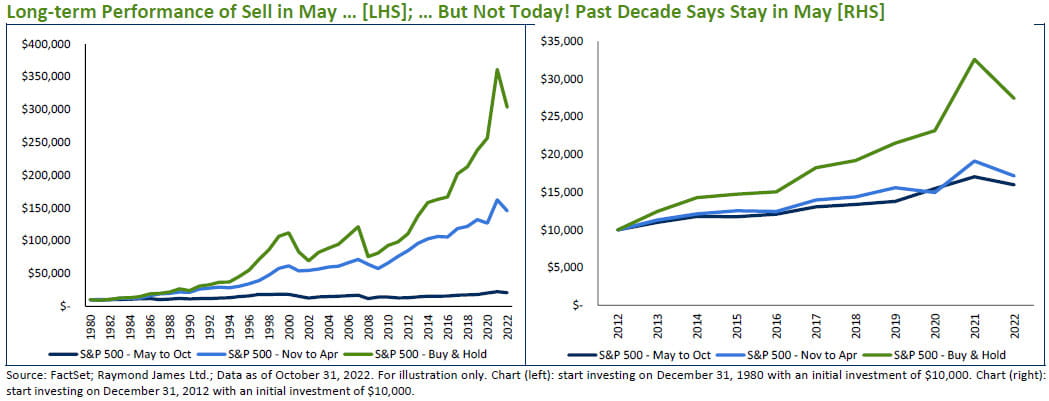

In finance, mental shortcuts are rules of thumb that provide simple solutions to complex problems. "Sell in May and go away" is one such classic example. This theory postulates that investors should exit the market between May and October while staying fully invested from November to April.

The November to April period indeed produces superior returns. Since 1981, 69 per cent of the time, November to April returns have exceeded those of May to October. The average return was 7.0 per cent versus 2.2 per cent, respectively. But for the sell-in-May theory to outperform a buy-and-hold strategy, one must invest the cash proceeds for six months at an annualized yield of approximately 4.5 per cent. In the good old days, when cash offered a competitive return, this strategy may have made sense (more on this later). As with any rule of thumb, this is worth revisiting occasionally. Over the past decade, the sell-in-May rule has been even more ineffective. The average May to October return has increased to 4.9 per cent (10.1 per cent annualized), thus creating an increased drag on performance for those following the shortcut and exiting the market.

A possible explanation for the improved May to October return profile over the past decade may have been the lack of alternatives to stocks (remember TINA: There Is No Alternative). While bonds and cash offered capital protection over the past decade, they provided little in return. Today, that has changed. It will be interesting to revisit this rule of thumb to see if the May to October return reverts toward its historical average.